Are you wondering, How do I distribute shares in my startup? If so, Startup Wars has some advice on the matter.

What is Equity?

Equity is ownership.

Equity can simply be described as ownership of a company or a part of a company. It is usually distributed by percentages of shares of stock in a company.

When a startup first begins, the founders usually own their entire company. If there is one founder, she/he will own 100% of their company. If there are two founders or more, you may divide the founders shares in agreed-upon percentages (50/50, 50/30/20, 50/40/10, etc).

Equity includes stock and earnings. It is also called invested capital.

Who Gets Equity in a Company?

- Founder/Co-Founders

- Employees

- Investors

- Advisory Board

Equity provides a financial stake in your company. It is an incentive to your investors or mentors, and it also can be given or earned as an incentive to your employees.

Every quarter your startup will need to analyze its profits, and then give a percentage of those profits to its equity owners. If your startup is successful, your stockholders will receive a greater amount of money.

How to Determine Percentage of Ownership in a Company

Every startup company has its own journey of formation, and each startup is unique.

Knowing how to split and negotiate equity in a startup isn’t as straightforward as you may think. Determining the exact percentages of ownership for your company can be tricky. There isn’t one perfect formula to draw from.

Factors to Determine the Percentage That Each Founder Should Receive

- What role will they play in the startup?

- What is their expertise?

- How high of a risk are they taking?

There are many players within a startup company, including a startup advisor compensation. Deciding who gets what is based on what they bring to the table.

To simplify, you can use a calculator. You can try an online ownership percentage calculator, like this one from foundrs, to get a brief overview.

Try to remember that it is important to clearly lay out your expectations for each of your founders from the start. This can evolve as your startup grows, but laying out a clear plan from the start can help avoid future issues.

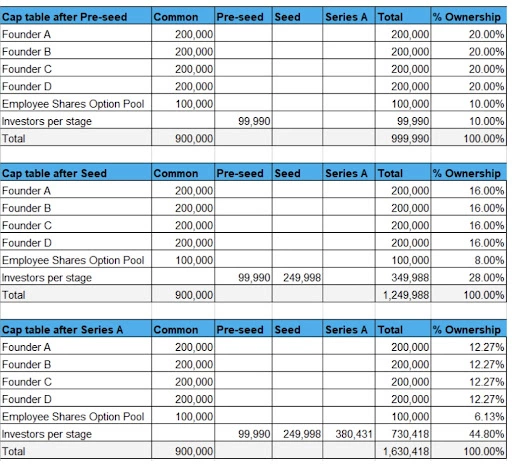

You can visually show your stake owners their options on a CAP table.

What is a CAP Table?

A CAP table is a capitalization table.

A CAP table is utilized to show the exact equity ownership for your company. It is crucial for making all financial decisions that are based on equity ownership and market value.

Your CAP table will help you regularly view the calculation of your startup’s unique market value. You can learn from it.

How to Create a CAP Table

CAP tables are most commonly created in a basic excel sheet form. There are also many templates that you can download for free to create your own.

Here is a sample of a CAP table from Eqvista so that you can see what one looks like:

The advantages of creating a CAP table on your own in excel is that you can learn as you go and create it from scratch. The disadvantages include the greater room for error.

You can also download templates from a company like Carta.

These templates are very easy to use and you can allow access to the CAP table easily with your team. Reports are generated for you, and they are always readily available.

Stock Option Vesting Schedule

A stock option vesting schedule is set up in a startup to inform your shareholders on when they can exercise their options on stock.

Your startup can customize this to your own personal needs. Often it is set up in schedules with popular terms like: a “one year cliff” option, a “four year” option, or a “single trigger” option.

Time based options, company milestone options, and a hybrid of both of these are common in startups. These schedules can be used to encourage your equity owners to jump in at the start, to stay once on board, and to invest as long as possible in your company.

The Bottom Line

Figuring out how to divide the equity for your startup founders, advisors and employees, isn’t that difficult a task if you follow simple formulas.

Once you know how to allocate the equity in your startup, you can focus on creating your startup business with clear expectations for you and your fellow founders.

Key Points

- Responsibility and idea-making come into play when determining your shareholder equity.

- Stock option vesting schedules are great for building exciting incentives within your startup for your investors and team.

- Take advantage of free online tutorials to calculate how to divide shares in your company.

- Use simple CAP templates to create an easily viewed map of shares.

Previous Chapter

How Your Credit Affects Your Business

Business credit can allow your company to gather the needed capital that is necessary for your operations.

Next Chapter

How To Do Small Business Accounting

It is very important for you and your investors to have an up-to-date overview of the financial situation of your company at all times.